Travel

The business account with zero baggage

Travel businesses — grow your customer base, optimise and automate your entire payment cycle, and save money on every booking.

Trusted by travel industry leaders

Your end-to-end payment solution

Accept payments with ease

Take payments online and in person, with low fees and high success rates. Our guaranteed 99.99% platform uptime means you’ll never miss a payment. Access your money within 24 hours, even on weekends.

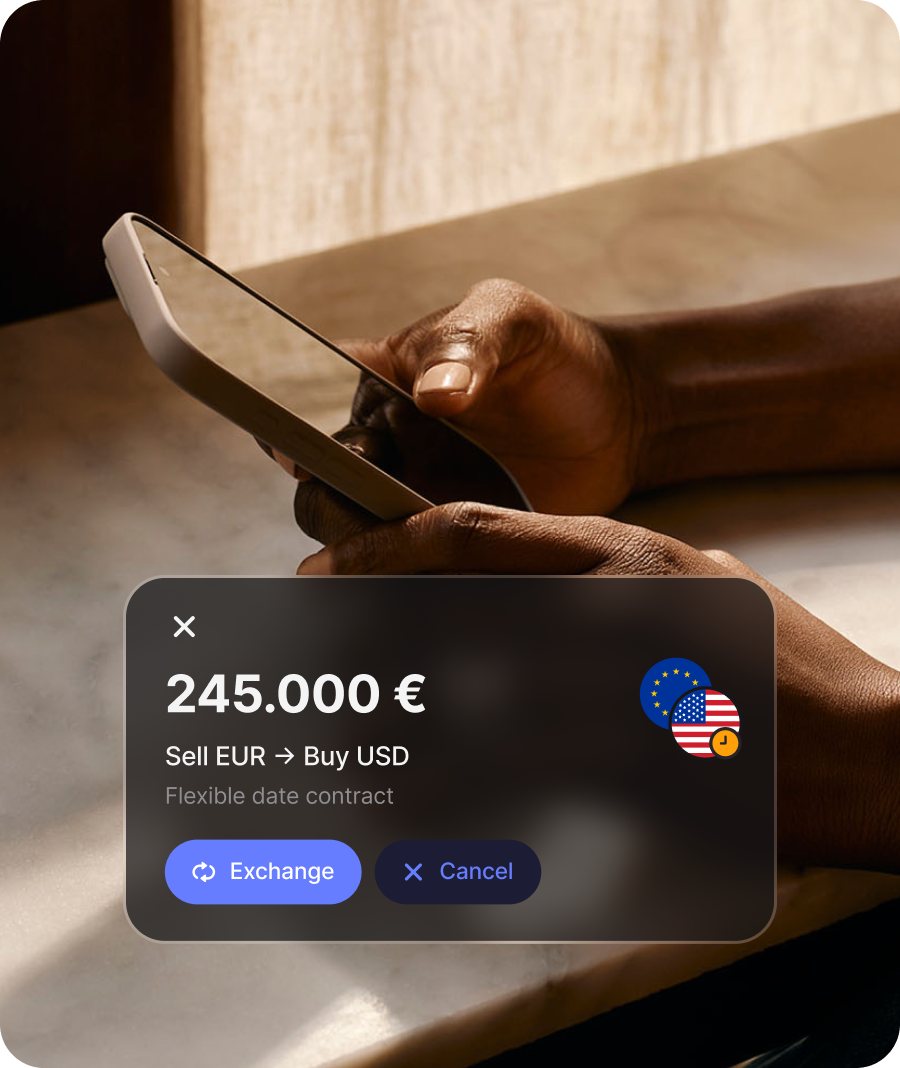

Do business in 25+ currencies

Accept, send, and exchange currencies at the same rates banks use (within plan allowance, during market hours), right from your Revolut Business account. Lock in exchange rates for up to 2 years with FX Forwards.

Automate card issuing, pay suppliers at scale

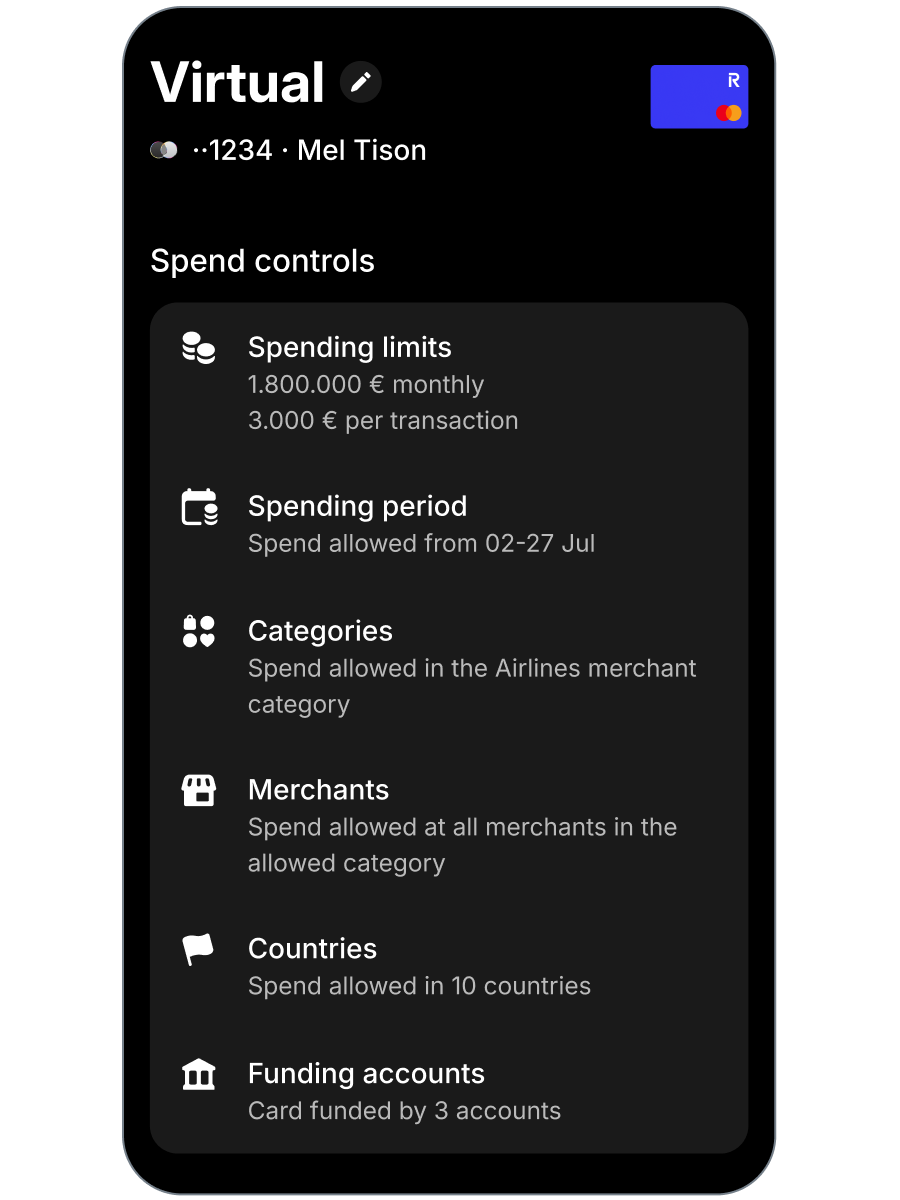

Issue virtual cards for every booking automatically — then pay suppliers in their preferred currency, in seconds. All without locking cash onto pre-funded cards.

A card full of currencies

Spend in 130+ currencies with one card, wherever you do business. Automatically draw from existing currency balances, or exchange at the interbank rate¹ as you pay. You can also link cards to specific currency accounts for teams or types of spend.¹Within plan allowance, during market hours. Fees and T&Cs apply.Get started

Your passport to scaling payments

Automatically issue a virtual card for every reservation. Pay your suppliers instantly in their preferred currency with zero fees. Enjoy high acceptance rates, no matter who you do business with — from airlines and hotels, to car hire companies and more.

Speak to our teamDrive sales with Revolut Pay

Let 65+ million global Revolut customers pay in 1 click with Revolut Pay, whether it’s a one-off or repeat purchase. You save on fees while driving sales, with an average 98.5% payment authorisation rate and virtually no insufficient fund failures.

And for every Revolut Pay purchase, customers can earn and redeem RevPoints as discounts at checkout.

Payment Processing Terms and fees apply.

Learn more

Spending, secured

Use custom controls and spend limits on local and global card payments for full control over your spend. That’s peace of mind, built into every transaction.

Get started

Reconcile in seconds

Connect tools you already use to your Revolut Business account, or use our API to instantly reconcile every transaction you make and receive. Keep your cashflow accurate and cut down on your admin.

Get started- “Thanks to Revolut Business, our virtual card acceptance rates have improved, driving smoother transactions.”Alžbeta Martišová, Treasury Manager • Kiwi.comRead more stories from travel leaders

- “At FlyGo, our goal is to accept payments in multiple currencies. After integrating the Revolut Payment Gateway, we’ve seen our conversion rates grow by 3%.”Sandra Matei, COO • FlyGoRead more stories from travel leaders

- “Using Revolut Business made my life easier managing finances in a big company. I can count on the wires coming on time, I can count on fair currency deals.”Krzysztof Węcławowicz, Head of Fintech & Partnerships • VolaRead more stories from travel leaders

- “Revolut Business has completely transformed how we manage expenses for our tour leaders. What used to be a slow and manual process is now seamless and automated, saving us valuable time while ensuring full compliance.”Massimo Grossi, CEO • Kel12Read more stories from travel leaders

The premier partner for travel businesses

Need a little more help?

FAQs

With Revolut Business, travel agencies can hold, send, and receive payments in 25+ currencies.

This means you can accept payments from customers in their local currency and settle payments into your Business account, without exchanging into another currency right away. When you decide to exchange, you'll be able to do so at the interbank rate (during market hours, within your plan's allowance).

You can also use our cards to spend in 130+ currencies at competitive rates.

Plus, our FX Forwards feature lets you lock in exchange rates for planned transactions, reducing currency fluctuation risks.

Yes, you can pay suppliers in their preferred currencies, right from your Business account. Revolut Business provides fast and cost-effective international transfers, helping travel agencies build strong supplier relationships.

Revolut Pay allows travel agencies to accept payments from 65+ million global Revolut customers — securely and in a click. It integrates seamlessly with your Revolut Business account, and it's a cost-effective payment acceptance option with competitive per-transaction fees.

Revolut Business has partnered with Sabre to provide auto-issued virtual cards via API, enabling travel agencies to manage bookings securely and efficiently.

When a customer books a trip with you, a virtual card is automatically created and loaded with the right transaction amount in the corresponding currency. You can then use it to pay your suppliers quickly, with competitive fees.

These cards simplify payments for flights, hotels, and other travel services, while enhancing security for every transaction.

Yes, Revolut Business integrates with popular accounting tools to streamline reconciliation. This saves you time and ensures accurate financial records. See our full list of integrations.

Revolut Business is an all-in-one financial solution that empowers travel agencies to save time, reduce costs, and focus on growth.

With our integrated Merchant account, you can accept payments directly into your Business account. That means there's no need for a separate service, which simplifies cashflow management and bookkeeping.

You can automatically issue a virtual card for every reservation made on your website, and pay suppliers instantly in their preferred currency. These virtual cards are accepted widely across airlines, hotels, car hire companies, and other partners.

Revolut Business also gives you access to features that simplify multi-currency spend. You can hold 25+ currencies in one account, and spend in 130+ using our debit cards. You'll get the interbank rate when you exchange (during market hours, within your plan's allowance), and you can lock in exchange rates for planned transactions with FX Forwards. Plus, our accounting integrations make reconciliation a breeze.