Plus for €3.99 per month

The account with banking extras

For the smart spender — access more benefits like better limits and purchase insurance. Paid Plan Terms apply.

Purchases, protected

Eligible items you buy with your Plus account are protected up to €1,000 for a year — even if they’re stolen or damaged. Insurance policy T&Cs apply.¹

Save on exchange fees

Spend up to €3,000 a month in 35+ currencies, without additional fees, Monday to Friday.

Access even higher exchange limits and unlock zero weekend fees, on our Premium and Metal plans.

Fair usage limits and added weekend fees may apply.

Compare plans

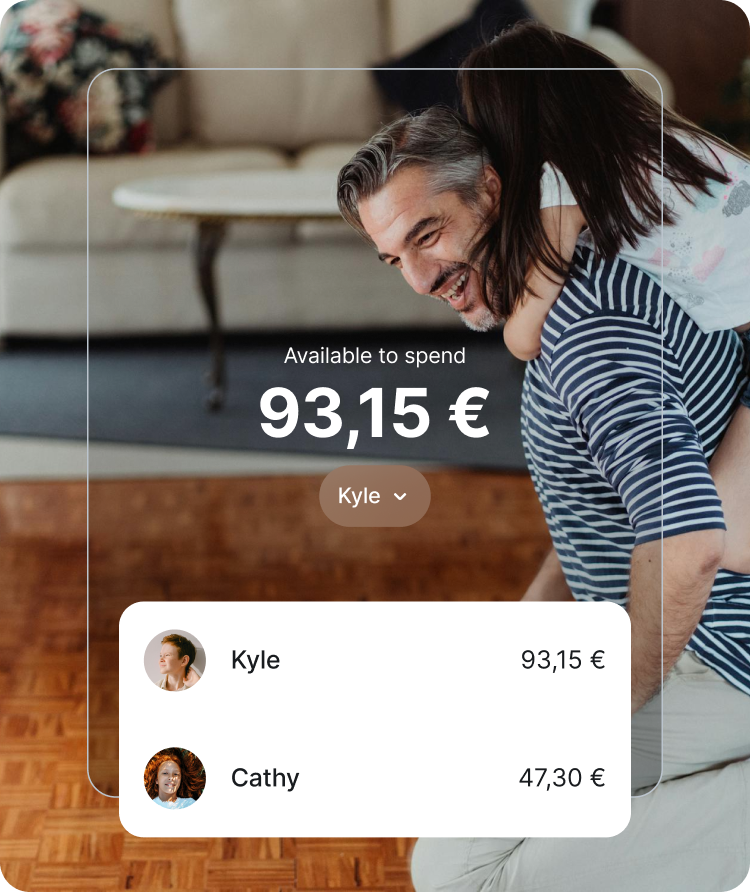

Bank with your kids, too

Open up to 2 accounts for your kids and a co-parent account with Revolut — Kids & Teens, and foster healthy money habits through budgeting goals and paid challenges. Make money a family matter. Kids & Teens T&Cs apply.

Explore Kids & Teens

Plus at a glance

Personalised Plus card

Unbox an exclusive Plus card and personalise it to make it uniquely yours.

Priority customer support

Access around-the-clock support from our team via in-app chat.

Fee-free ATM withdrawals

Never get caught without cash with €200 each rolling month with no fees from us. After your limit a 2% fee applies per transaction. Third-party fees may apply.

Kids & Teens

Link up to 2 Kids & Teens accounts, for family members aged 6–17.

Revolut Pro

Optimise your side hustle, with the account for freelancers, with 0,6% cashback on Pro card payments. Fees apply for acquiring features. T&Cs apply.

Your money, protected

Trusted with €36 billion in customer funds — our cutting-edge security features, and award-winning customer support, helped prevent more than €746m worth of fraud in 2024 alone.

Not all financial services available in the Revolut app are eligible for deposit protection. Please refer to the FAQ for more details.

Read more

Looking for a more elevated lifestyle?

Compare all our plans with ease, and choose the one that works for you.

Opening a bank account or upgrading to the Plus plan does not guarantee access to all services provided in-app, these may be subject to meeting additional eligibility criteria and, in some cases, completing the registration to other entities of the Revolut group.

Revolut Plus is a 12-month plan with an option of monthly and annual billing. You'll be able to cancel your plan anytime. However, you may be charged a fee depending on when you cancel your plan. You'll still be able to benefit from the services you get on your plan until the end of your billing cycle you've paid for, excluding any break fee. Read more under Fees for downgrading your Paid Plan in our Paid Plan Terms.

¹For Insurance. Insurance distribution service is provided by Revolut Insurance Europe UAB which is authorised by the Bank of Lithuania as an insurance broker undertaking. Registered address: Konstitucijos ave. 21B, Vilnius, 08130, the Republic of Lithuania, number of registration 305910164.

²For Investing. Capital at risk. Investment services are provided by Revolut Securities Europe UAB. Information contained herein is not a personal recommendation, investment advice or offer to take any investment decision, therefore you must carefully consider your financial situation, review relevant documents and information or seek professional independent advice before entering into financial transactions or subscribing to new investment services. T&Cs apply. The value of investments can go up as well as down and you may receive less than your original investment or lose the value of your entire initial investment. Past performance and forecasts are not a reliable indicator of future results. Currency rate fluctuations can adversely impact the overall returns on your original investment. Further information can be found on our Risk Disclosure and Invest FAQ.

Revolut Securities Europe UAB (company code: 305799582; registered address: Konstitucijos ave. 21B, Vilnius, the Republic of Lithuania, LT-08130) is a Lithuanian investment firm authorised and regulated by the Bank of Lithuania. Revolut’s cryptocurrency services are offered by Revolut Ltd (company code: 08804411; registered address: 7 Westferry Circus, Canary Wharf, London, England, E14 4HD) or Revolut Digital Assets Europe Ltd (company code: HE430310; registered address Pikioni, 10 Flat/Office 5, 3075, Limassol, Cyprus). Commodities services are provided by Revolut Ltd.

Revolut Bank UAB is a bank established in the Republic of Lithuania authorised and under supervision by the Bank of Lithuania and the European Central Bank, more information here https://www.revolut.com/en-BE/