Accept payments

Payments built for growth

Combine your sales and your business banking into one account with Revolut Business. From next-day settlement to transparent fees — access everything together.

Join tens of thousands of global merchants already processing payments with Revolut Business

Sell in person and online

From the Revolut Terminal to our Point of Sale app, find the in-person payment acceptance solution suited to how you do business.

One platform. Total control.

Accept online and in-person payments directly into the account you use for banking with Revolut Business.

24-hour settlement

Accept payments directly into your Merchant account, then access your money the next day. Even on weekends. T&Cs apply.

No hidden fees

Only pay for successful sales with in-person rates starting at 0.8% + €0.02 per transaction, and 0.5% + €0.02 for Revolut Pay.

Settle in 32 currencies

Accept payments in different currencies with the flexibility to hold funds at no charge until you choose to exchange.

98.5% authorisation

Boost conversions when customers pay directly from their Revolut account via Revolut Pay.

99.99% uptime

Never miss a sale — our in-house payment processing platform boasts a near-perfect uptime.

Sell to 65m+ customers

Spotlight your business in-app with a Revolut Pay Promotions campaign.

Drive revenue with Revolut Pay

Save on fees when customers pay directly from their choice of Revolut account in 1 click with Revolut Pay. They automatically earn double RevPoints to redeem as discounts, at no cost to you.

Learn more

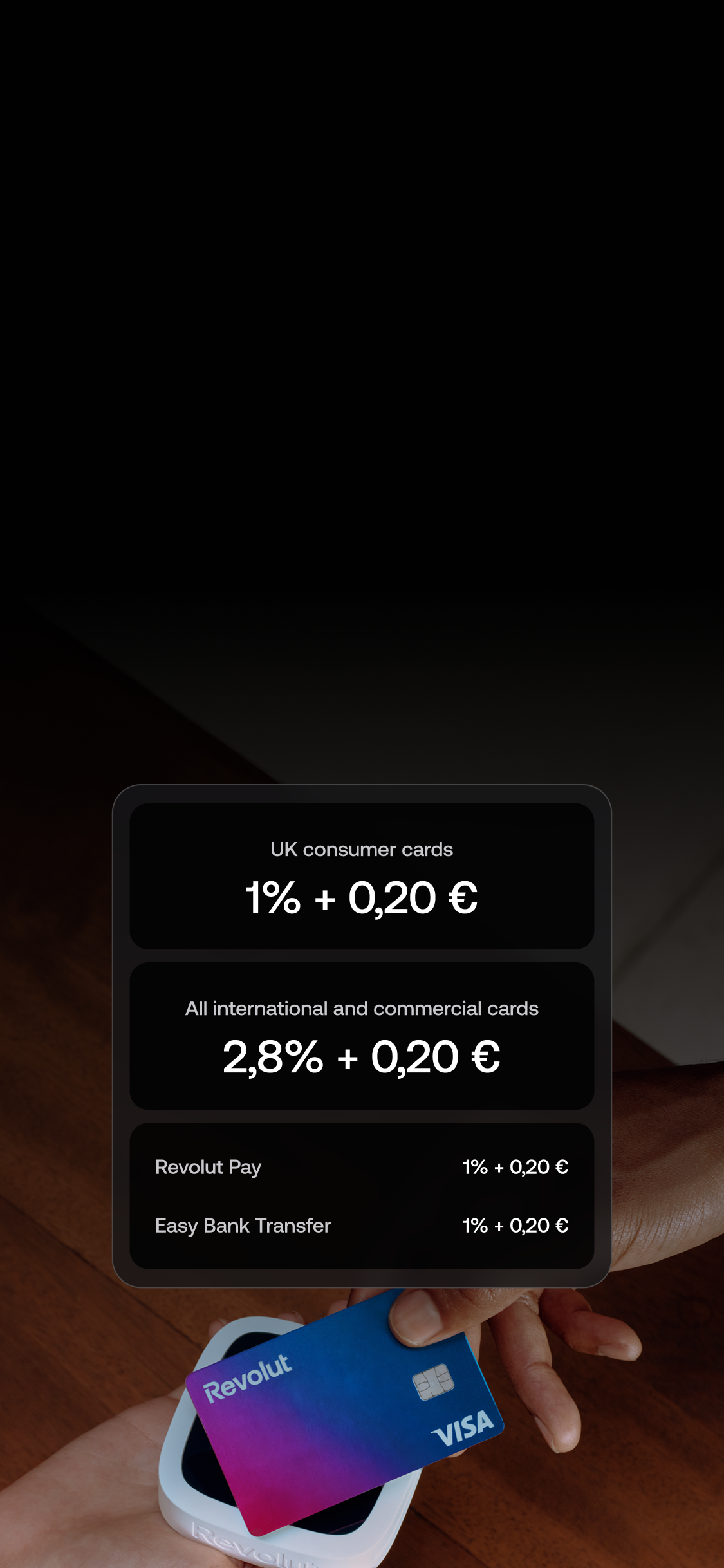

No hidden fees

Our clear, transparent payment processing fees are built for businesses of all sizes. No monthly minimums. No set-up charges. So you keep more of what you earn.

Payment processing fees are separate from Revolut Business plan subscriptions.

Learn moreHow to set up a Merchant account

Sign up for a Revolut Business account

It should take approximately 10 minutes.

Add a Merchant account

Select the category that best describes your business, and enter your business description.

Provide proof of business

This could be your registration listing, website, or social media page.

- “Revolut Pay allows customers to pay for affordable air travel on Wizz Air directly from their Revolut account of choice, including savings and multi-currencies. By offering added RevPoints on every transaction, customers are encouraged to book again and redeem them as discounts on their flights, driving customer loyalty and satisfaction.”Ian Malin, Chief Financial Officer • Wizz Air

- “We used Revolut Business in-person payment tools to process payments on-site at Primavera Sound. Revolut Terminals' offline mode ensured we could keep payments flowing - no matter the Wi-Fi situation. They are fast and reliable, giving us total peace of mind that even during peak processing hours, payments will be seamless, meaning shorter queues and more sales.”Marc Piedró, Sales Manager • Primavera Sound

- “Revolut Pay is a fast and secure payment option which improves customer satisfaction. It gives our customers flexibility and offers lower fees than most credit cards.”Fabien Mollinari, Payments Product Manager • Aer Lingus

FAQs

A payment processor, also known as an acquirer, is a company that handles transactions between a merchant and financial institutions. Payment processors help to authorise and settle credit and debit card payments, making sure funds are securely transferred from customer accounts to merchant accounts. Revolut Business is a payment processor, and also offers a Merchant account to accept sales payments for your goods and services.

- Cost and fees: check how much it will cost to use each payment provider, and the fees your business will be charged for each sale

- Trust and security: make sure your chosen payment provider offers security and fraud prevention features

- Scale: is the payment provider suitable for the scale of your business, and able to process the number of transactions you need?

- Payment types accepted: can your payment gateway accept payments used by your customers, like Visa, Mastercard, or American Express? Also check if it offers both one-off and subscription type payments

- Currencies and regions supported: make sure your payment provider supports your most commonly-used currencies and regions, especially for online payments

As this is not an exhaustive list of things to consider, we encourage you to carry out further research when choosing a payment provider.

A Revolut Merchant account allows your business to accept payments made with both debit and credit cards. Your Merchant account is separate from your main Revolut Business account, and will be used to store payments from your customers, which you can move into your main Business account. You can also set up auto-withdrawals, to automatically move funds from your Merchant account into your Business account.

Businesses that want to accept credit card and debit card payments typically need a Merchant account.

Businesses operating exclusively through third-party platforms or marketplaces may not need their own Merchant accounts, as these platforms often handle payment processing already.

You can choose between Revolut Terminal and Revolut Reader for in-person payments (depending on region availability).

These card machines enable your business to take payments anywhere, in under 3 seconds. Both Reader and Terminal support all major payment methods, including chip and PIN and contactless payments.

We also offer a Point of Sale (POS) app for iPad for in-store payments, as well as Tap To Pay on iPhone, QR codes, and Payment Links, for speedy transactions straight from your phone.

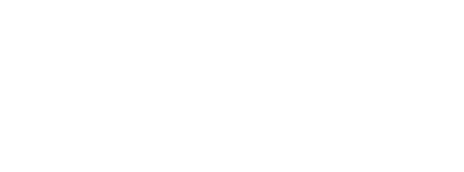

Revolut Pay provides a frictionless checkout option for your online customers. It also gives you access to the global Revolut customer base, allowing them to pay you directly from their account.

We also offer several other options for accepting payments online:

- Process card and Revolut Pay transactions on major platforms like Shopify and Magento with our no-code plugins

- Create a custom checkout experience with our Merchant API

- Activate Revolut Pay in 1 click if you already use Stripe

Pay per transaction starting from 0.8% + €0.02. Only pay for successfully processed payments, without the contracts or commitment — and at some of the lowest fees around.

Explore our pricing.

Revolut Business supports all major types of payments, in over 25 currencies including GBP, EUR, and USD.

You can accept:

- in-person chip and PIN, contactless, or online payments from all major card providers, including Mastercard, Visa, American Express, and Maestro, as well as mobile wallets including Apple Pay and Google Pay

- one-time, or repeat online payments with Revolut Pay. You can integrate a card field, card pop-up, or a hosted checkout page into your website

Your customers can save their card details to save time on future transactions. You can also process merchant-initiated transactions (MIT) to set up and manage subscriptions. Learn more in our Merchant API Documentation.

Payments you receive from your customers will be settled into your Merchant account — which is inside your Business account, and only receives payments from your sales. To make use of this money, you'll need to move it out of your Merchant account into your Business account.

You can move money from your Merchant account to your Business account going to Merchant → Withdraw. You can move money from your Merchant account to your Revolut Business account at no cost.

You can also enable auto-withdrawals to automatically move funds from your Merchant account into your linked Business account at the end of each day. Auto-withdrawals work only with the same currency accounts, i.e. from GBP to GBP.

Here's how to switch on auto-withdrawals:

- Go to your Merchant account

- Click on your Merchant account balance

- Select the currency account you want to auto-withdraw from

- Open Details → toggle on Auto-withdrawals