Flexible Cash Funds

Turn your idle business cash into investments

Invest your company's spare cash in low-risk money market funds, and earn variable returns at great rates, accrued daily. Capital at risk. The value of investments can go down as well as up. T&Cs apply.

Invest in 3 currencies

Earn returns accrued every day, depending on each fund’s performance, with flexible withdrawals.³ And make sure your business' spare cash is always working — even when you're not.

Up to

Up to3,65 %

APY¹ on GBP

Up to

Up to3,91 %

APY¹ on USD

Up to

Up to1,82 %

APY¹ on EUR

¹The Annual Percentage Yield (APY) is presented net of fees for all displayed currencies as of 1/10/25 and is based on information provided by the fund manager, subject to change daily. This is the highest APY offered to Enterprise customers. Your APY may be lower depending on your subscription plan and applicable fees. Currency rate fluctuations can adversely impact the overall returns on your original investment. Past performance is not a reliable indicator of future results.

What are Flexible Cash Funds?

Flexible Cash Funds are a way to grow your money by investing in money market funds. Each fund invests in different assets — like government-guaranteed securities for the USD fund, or bank deposits and bonds for the EUR and GBP funds. Banks and large corporations have used these types of funds for years to protect against inflation, amongst other reasons, while keeping the risk of capital loss low.Visuals including APYs, invested amounts, and returns paid are shown for illustrative and informational purposes only.

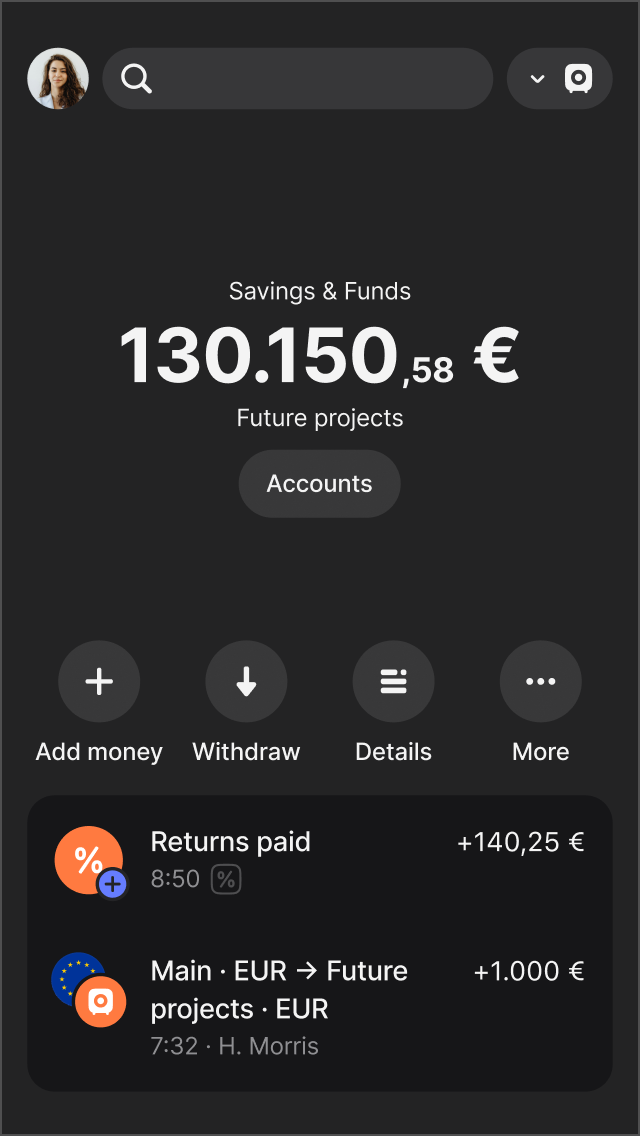

Start investing

Easily access your funds

Add and withdraw money from Flexible Cash Funds without any fees or restrictions from us. Withdrawals typically land in your Business account within 2 business days⁴ — and you can make them extra secure by activating Wealth Protection, our advanced facial recognition technology.

Get started

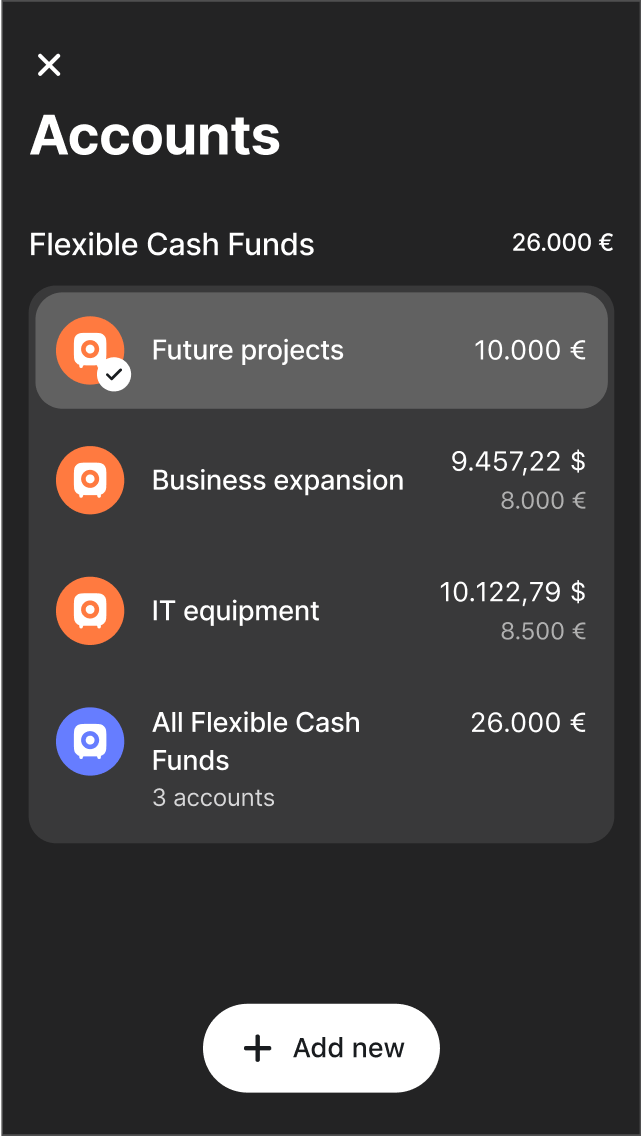

Invest with no limits

We don’t do minimum or maximum investment amounts. You’re free to open up to 100 Flexible Cash Funds for your business across the available currencies (EUR, USD, or GBP) — with no limit on how much you can invest.

Sign up

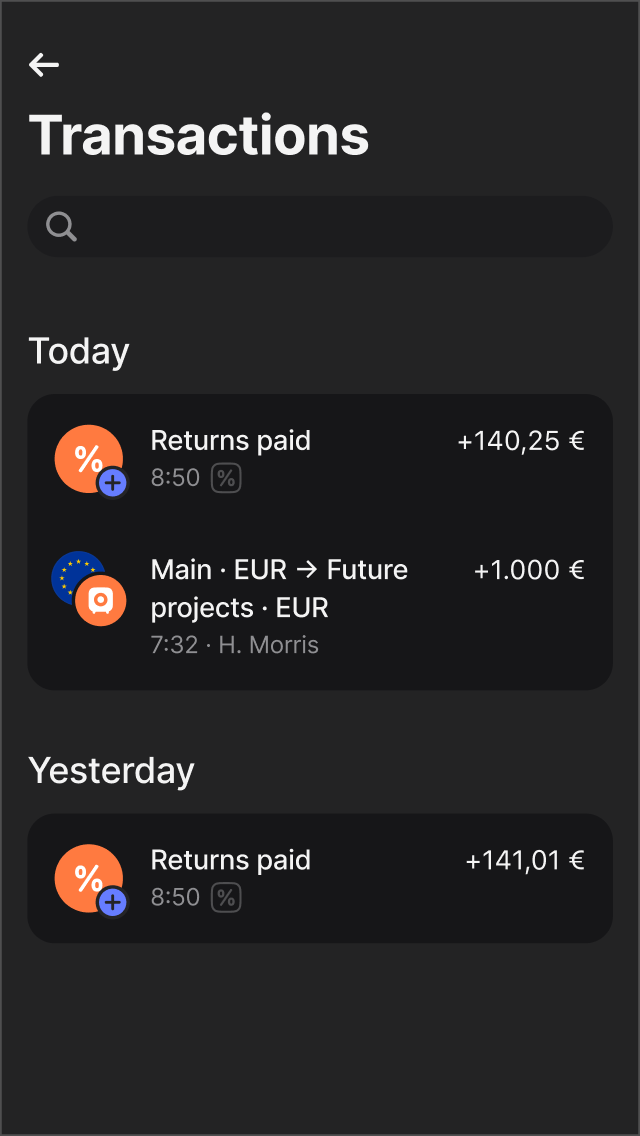

Track every movement

Connect your Flexible Cash Funds to your accounting software and see your withdrawals, top-ups, and returns in one place. Your data automatically syncs, saving you hours of admin while keeping your transactions accurate.

Grow your moneyGreat rates, flexible plans

Net annual return rates on EUR (variable)

Net annual return rates on GBP (variable)

Net annual return rates on USD (variable)

Currency rate fluctuations can adversely impact the overall returns on your original investment. Past performance is not a reliable indicator of future results.

About the risks

Our selection of FIDELITY money market funds, available with Flexible Cash Funds, aims to preserve capital value, a constant share price, and liquidity, while producing regular returns for investors, in line with money market rates. However, returns are not guaranteed and could vary daily depending on the fund's performance, amongst other factors. In some rare situations like stressed market conditions, investors could lose part or all of the money invested. Although the risk indicator for these funds is low (1 out of 7, for a 6-month holding period), investing in money market funds involves risks such as market, liquidity, and credit risks. Read the latest Key Information Document and the Prospectus, available in the app. When investing in a foreign currency (for example, USD), you may incur a fee when you exchange your money. Your final return will also depend on the currency conversion rate, which could reduce your returns if you convert them back into your desired currency. Please assess your financial situation carefully and consider seeking independent advice before investing. This is not investment advice, an offer, or a recommendation. You’ll only be able to invest in this selection of FIDELITY money market funds through Revolut’s Flexible Cash Funds service, and you won't be able to transfer these instruments elsewhere.

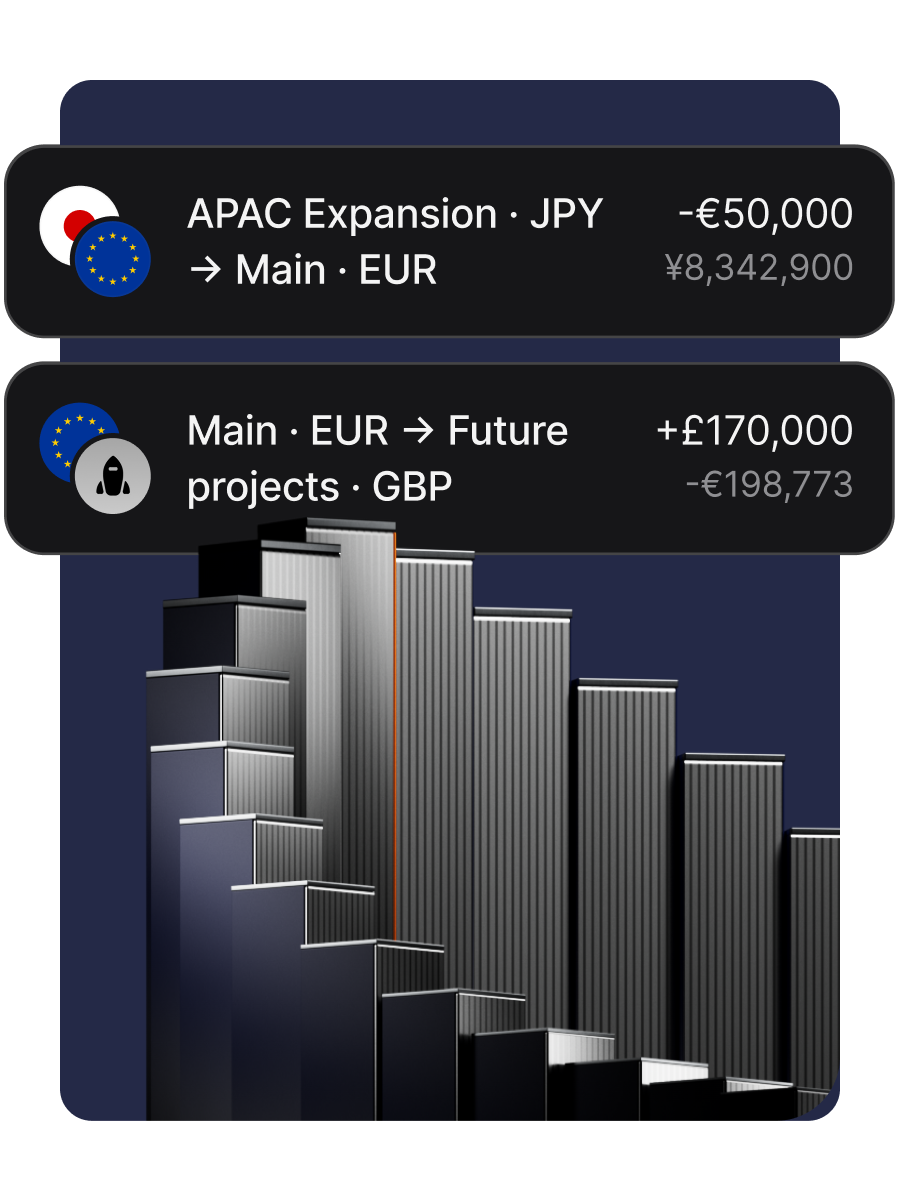

Invest strategically, without limits

Need a little more help?

FAQs

Flexible Cash Funds are available for all businesses on our Grow, Scale, and Enterprise plans. They're not available to Basic plan customers at the moment.

Also, for specific reasons — like your business having multiple tax residencies — we might restrict your access to Flexible Cash Funds.

You can find more information in our Flexible Cash Funds FAQs.When you add or withdraw money through Flexible Cash Funds, you're buying or selling shares in a money market fund in the same currency — either EUR, USD, or GBP.

Within each fund, there may be different share classes. The share class available to you is Class R Flex Distributing shares of these short-term and actively-managed money market funds:

- The USD Treasury Fund (ISIN IE000ZEZXAJ7)

- The Euro Fund (ISIN IE000AZVL3K0)

- The Sterling Fund (ISIN IE0002RUHW32)

The USD Treasury Fund is a Constant Net Asset Value (CNAV) money market fund, which invests mostly in US Treasury obligations backed by the US Government.

The Euro Fund and Sterling Fund are Low Volatility Net Asset Value (LVNAV) money market funds, which invest in:

- high-quality and liquid money market instruments, like government securities, bank obligations, and commercial paper

- high-quality securitisations and asset-backed commercial paper deposits with credit institutions

- repurchase agreements and reverse repurchase agreements

- shares in other money market funds

The money market funds you invest in through our Flexible Cash Funds are sub-funds of Fidelity Institutional Liquidity Fund plc, a UCITS open-ended umbrella fund authorised by the Central Bank of Ireland (CBI) (registration number: 235175).

The fund manager is FIL Investment Management (Luxembourg) S.à.r.l., Ireland Branch, which is authorised by the Commission de Surveillance du Secteur Financier (CSSF) (registration number CCSF: S00000593; CBI: C137514).

The fund manager has appointed an investment manager and delegated the fund’s portfolio's day-to-day management to FIL Investments International.

For more information, please read the fund's Prospectus and the respective Key Information Documents (KID), available on the fund's website and in the Revolut Business app.

You can find more information in our Flexible Cash Funds FAQs.Low Volatility Net Asset Value (LVNAV) money market funds are short-term, and primarily invest in money market instruments, deposits, and other short-term assets. Units in the fund are purchased or redeemed at a constant price, so long as the value of the underlying assets doesn't deviate by more than 0.2% (20bps). Yield is the main factor in the fund's value.

Constant Net Asset Value (CNAV) money market funds are also short-term, but these invest mostly in government assets. Units in the fund are purchased or redeemed at a constant price.

Find out more in our Flexible Cash Funds FAQs.Yes — you can open up to 100 Flexible Cash Funds across any of the 3 available currencies, with no minimum or maximum investment amounts. Each currency (EUR, USD, and GBP) represents a different money market fund. Each fund performs differently, and fees will vary depending on your plan and region.

Find out more in our Flexible Cash Funds FAQs.There are no account opening or closing charges. However, we do charge a small service fee to cover our costs of service, which is automatically deducted from the daily returns you accrue.

The Ex-ante Costs and Charges Disclosure is available in the Savings & Funds section of your app under Regulatory documents.

It’s your responsibility to find out whether you need to declare and/or pay tax on your Flexible Cash Funds investments. We won’t process your tax payments proactively and send them to relevant tax authorities. We’ll only withhold or levy taxes to you if we’re mandated to perform that obligation to comply with relevant laws in certain jurisdictions.

You should seek independent tax advice if you have any questions. We don’t provide tax advice.

Find out more in our Flexible Cash Funds FAQs.APY stands for Annual Percentage Yield, and represents the return on investments net of fees. So, APY refers to the return you'd earn by investing in a money market fund (through Flexible Cash Funds) assuming a holding period of 12 months if the rate remained constant (which in practice varies daily).

The APY varies by fund based on the performance, as well as by plan and region depending on the fees.

More information on APYs and fees per subscription plan are available in our Flexible Cash Funds FAQs and in the Ex-ante Costs & Charges Disclosure.

²The risk indicator summarises the level of risk of an investment product on a scale of 1 to 7 (where 1 represents the lowest risk, and 7 represents the highest risk). It allows investors to compare the risk level of different investment products under the same methodology (PRIIPs Regulation (EU) No. 1286/2014). The risk indicator shows how likely it is that the investment product will lose money because of market movements or because the issuer isn't able to pay you. However, the risk indicator doesn't consider currency risk if you're investing in a currency different from your base currency.

The risk indicator of 1 out of 7 for these funds indicates that the potential losses from future performance are very low, and that poor market conditions are very unlikely to impact the fund's capacity to pay you. This risk indicator is provided by the fund manager. These funds don’t include any protection from future market performance, so you could lose some or all of your investment. The recommended holding period for these funds is 6 months. If you sell your shares earlier, the risk indicator could vary significantly. Before investing, read the Key Information Document available in-app.

³The funds are rated AAA-mf by Moody’s and AAAm by Standard & Poor’s. These ratings were solicited by the manager of the fund, and financed by either the manager or the fund. Funds are not guaranteed investments. They do not rely on external support to guarantee their liquidity or stabilise the net asset value of their shares.

⁴When selling your shares in the money market funds available, the sale proceeds can take up to 2 business days to reach your Revolut Business account. Exceptionally, the sale of your shares could take longer or be charged exit fees in those situations described in the Prospectus, like stressed market conditions. The recommended holding period for these funds is 6 months. The risk indicator of 1 out of 7 can vary if you sell your shares earlier.

Investment services are provided by Revolut Securities Europe UAB. Information contained herein is not a personal recommendation, investment advice, or offer to take any investment decision. Therefore, you must carefully consider your financial situation, review relevant documents and information, or seek professional independent advice before entering into financial transactions or subscribing to new investment services.

More information is available in the Ex-ante Costs & Charges Disclosure. T&Cs apply.

Revolut Securities Europe UAB (company code: 305799582; registered address: Konstitucijos ave. 21B, Vilnius, Lithuania, LT-08130) is a Lithuanian investment firm authorised and regulated by the Bank of Lithuania and provides its services in other EEA countries under the Freedom of Services regime without branches or tied agents.

FIDELITY and FIDELITY INTERNATIONAL are trademarks of FIL Limited and are used with its permission. Visit the FIDELITY website for further information.