Revolut 6-17 | Parents and guardians

The subaccount for kids and teens

A Revolut app and prepaid card for 6-17 year olds. Empower your kid to learn about money, in a parent-supervised space. T&Cs apply.

Independence for them, peace of mind for you

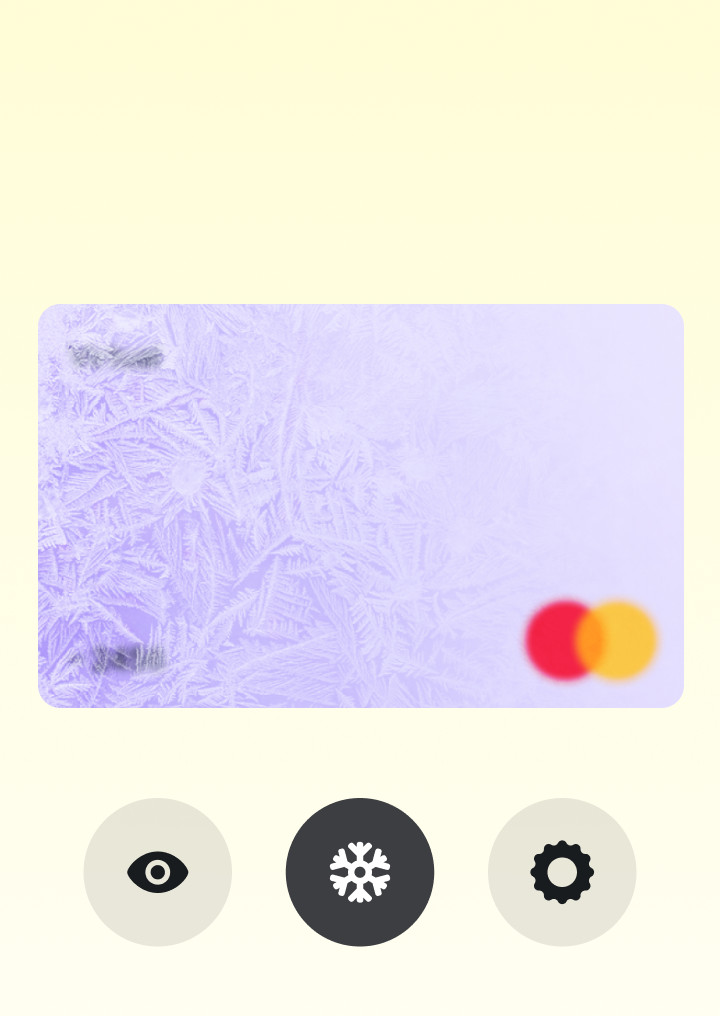

Kids get the financial freedom of their own app and card, while you get visibility on your app. From spending limits to in-app card freezing, you’ve got total oversight.

Get Revolut

Cards uniquely theirs

Let your kid’s personality shine through with card customisation. They can use their personalised card to make payments and withdraw from ATMs, even if they’re travelling abroad. Or they can go fully digital with virtual cards and add them to their Apple or Google Wallet.

Customisation and delivery fees may apply. Minimum age applies.

Order their cardReceiving money, from: you

You and your co-parent can set up recurring payments to automate their allowance, giving them a regular 'payday'. Kids and teens can also request money when they need it.Open their subaccount

Money, organised

Give your kid the tools to set aside money for specific purposes — whether that's a new pair of earbuds, or dinner with friends. Subaccounts are not savings accounts and do not earn interest.Help them open a subaccount

How to open a Kids & Teens subaccount

Get the app

Have your kid download the Revolut — Kids & Teens app and create a subaccount. If they’re 12 or under, you’ll need to create their subaccount from your Revolut app.

Approve

If they’re 13 or over, we’ll send you a notification for you to approve their subaccount from your Revolut app.

And go

Order their card, customise it together (fees may apply), and add it to their Apple or Google Wallet (if they’re old enough).

Kids & Teens subaccounts are available for ages 6-17, and parent or guardian must be 18+ and have a Revolut account.

Teens aged 13+ can create a subaccount with parent or guardian approval. Payments to and from other customers on Revolut — Kids & Teens are only available to teens aged 13+.

Some products and features are only available for kids above a certain age. See availability in-app or within our FAQs.

FAQs

To open a Revolut — Kids & Teens subaccount, you need to be a legal guardian and have an existing Revolut account.

You can then set up a Kids & Teens subaccount for your kid or teen through your main Revolut app.

Get the Revolut appThey can have a Kids & Teens subaccount when they're between 6-17 years old.

LabelYes, you can open a Kids & Teens subaccount in a few taps directly through the main Revolut app.

It's free for one subaccount, but you'll need to upgrade if you want to include multiple kids, each with their own subaccount. Other fees like personalisation of debit cards may apply. See full information in the T&Cs.

Yes, they can use their Kids & Teens subaccount abroad.

Their prepaid card works just like your Revolut card for making purchases online or in person, and for withdrawing money from ATMs, even when overseas.

If your kid or teen makes a purchase in a currency different from the base currency of your Revolut account, the transaction will be converted in the same way as it would be on your own account. The value of foreign exchange allowed before a high-frequency fee applies is less than your own account. See all fee info in the T&Cs.