Banking & beyond

Whether home or away — let Revolut exceed your banking expectations. Sign up for free, in a tap.

Download the app

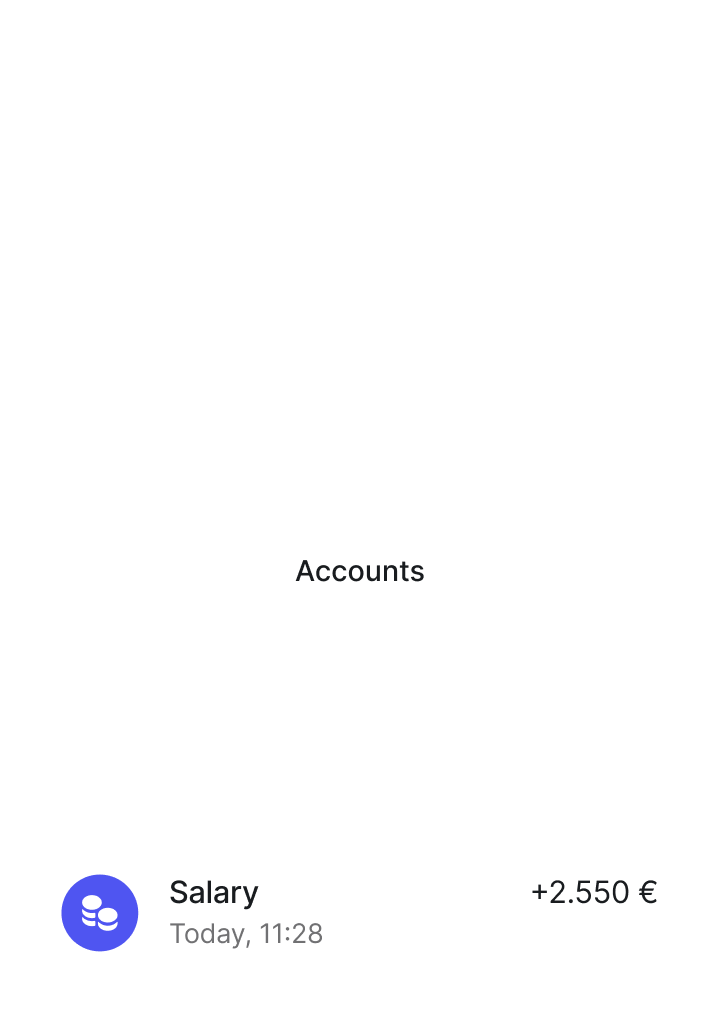

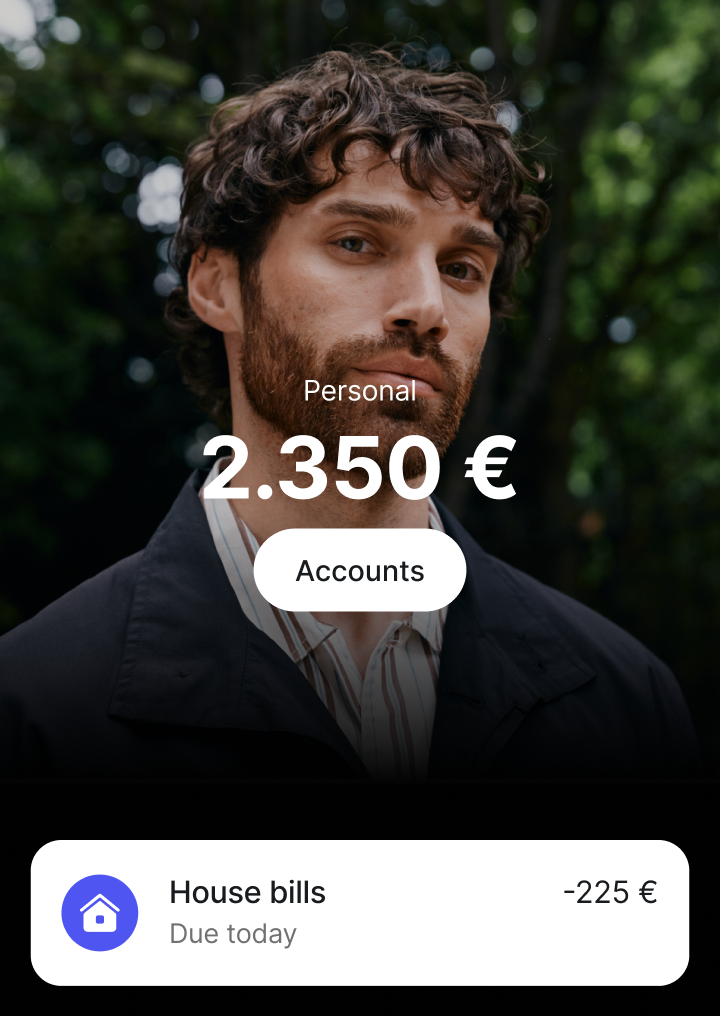

Your salary, reimagined

Spend smartly, send quickly, sort your salary automatically, and watch your savings grow — all with Revolut.

Move your salary

The bank 640,000 people in Lithuania use

#1 most downloaded banking app

4.6 out of 5 on Trustpilot

World's Best Digital Bank 2025

Best Consumer Banking Mobile App 2025

World's Most Innovative Companies 2024

Consumer Finance App of the Year

Elevate your spend

Get points on every eligible purchase with one of our debit cards, then redeem for Airline Miles, Stays, and other travel discounts. RevPoints T&Cs apply.Some cards available on paid plans only. Fees may apply.Choose your card

Life, meet savings

Grow your money with up to 2.5% p.a interest, paid every day. And save with no penalties or fees.The interest rate is variable and subject to your selected plan. T&Cs apply.²Explore savings

Credit you can score with

Whether you’re looking to enhance your spend with a credit card or planning for the long-term with loans — all of our credit options are competitive, clear, and flexible.³

Trade with 0% commission

Turn your salary into long-term wealth with 3,000+ stocks and ETFs — all in one single app. More money goes into every investment with no commission or custody fees,⁴ depending on your monthly allowance. Other fees may apply.⁵Capital at risk.Try it out

Your way into crypto

All the tools you need to trade quickly and transfer easily — all in our secured app. Fees starting at 0%, depending on your plan and trading volume.

Crypto is volatile and not regulated or protected — value can go down or up. Taxes may apply. Fees payable.⁶

Try it outYour money’s safe space

With Revolut Secure, you’re entering a new era of money security — where our proactive, purpose-built defences and team of fraud specialists help protect every account, 24/7.

Learn moreJoin the 65+ million using Revolut

Eligible deposits are insured by the Lithuanian Deposit Insurance Scheme but some exceptions may apply. Learn more.

FOR PERSONAL LOANDS AND CREDIT CARDS

¹RevPoints are a loyalty feature linked to your Revolut plan, not a benefit of your credit card. Credit card and plan are separate products — you don’t need to change your plan to apply. RevPoints require activation. T&Cs apply.

Representative example: get a €4,100 credit limit with an annual fixed interest rate of 15% by signing an open-ended contract. Assuming that you use the credit limit for 3 months, the total amount payable will be €4,255.01, while the APR (Annual Percentage Rate) will equal 16.08%. If you use your credit, the minimum monthly payment will be 3% of the used credit but not less than €10 and accrued interest (if any). There won’t be any monthly payments or any interest if you don’t use the credit.

What is the effective APR? (APR: annual percentage rate) — the effective rate charged for your loan, which includes the total interest rate plus any additional fees and charges.

Credit is a commitment and must be repaid. Check your ability to repay before committing yourself. All credit card applications are subject to approval.

²Instant Access Savings offer annual interest paid daily. The interest rate depends on the type of plan you have, from 2% per annum in the Standard Plan to 3.5% per annum in the Ultra plan. The maximum deposit amount is €100,000. We have a right to change the interest rate as defined in the Terms. Eligible deposits are insured by the Lithuanian Deposit Insurance scheme (Public Institution “Deposit and Investment Insurance”). Revolut Bank UAB is a bank established in the Republic of Lithuania authorised and regulated by the Bank of Lithuania and the European Central Bank, more information on our Lithuanian website.

³Grace period refers to the period during which interest is accrued but not charged on purchases. The period runs from the first day of the billing cycle or the first day of the month, until the next due date or the last day of the next calendar month. You need to repay in full by the due date or the end of the grace period to avoid being charged interest.

FOR INVESTING: Capital risk

⁴Custody fees are operational charges that some financial service providers pass on to investors for providing them the service of holding in custody their financial instruments. We don’t charge custody fees on our investment services.

⁵The value of investments can go up as well as down and you may receive less than your original investment or lose the value of your entire initial investment. Past performance and forecasts are not a reliable indicator of future results. Currency rate fluctuations can adversely impact the overall returns on your original investment. Further information can be found on our Risk Disclosure and Invest FAQ.

Investment services are provided by Revolut Securities Europe UAB. Information contained herein is not a personal recommendation, investment advice or offer to take any investment decision, therefore you must carefully consider your financial situation, review relevant documents and information or seek professional independent advice before entering into financial transactions or subscribing to new investment services.

Revolut Securities Europe UAB (company code: 305799582; registered address: Konstitucijos ave. 21B, Vilnius, Lithuania, LT-08130) is a Lithuanian investment firm authorised and regulated by the Bank of Lithuania. Revolut’s cryptocurrency services are offered by Revolut Digital Assets Europe Ltd (RDAEL) (company code: HE430310; registered address: Pikioni, 10 Flat/Office 5, 3075, Limassol, Cyprus). Commodities services are provided by Revolut Ltd (company code: 08804411; registered address: 7 Westferry Circus, Canary Wharf, London, England, E14 4HD).

⁶FOR CRYPTO: Capital at risk.

You must be satisfied that this crypto offering is suitable for you in light of your financial circumstances and attitude towards risk before starting. The price or value of cryptocurrencies can rapidly increase or decrease at any time (and may even fall to zero). The risk of loss in holding cryptocurrencies can be substantial. Funds received by us in relation to cryptocurrency transactions will not be safeguarded or covered by the Cyprus Investor Compensation Fund. We do not make any representation regarding the advisability of transacting in cryptocurrency. We cannot guarantee the timeliness, accurateness, or completeness of any data or information used in connection with you holding any exposure to cryptocurrencies.

Revolut’s cryptocurrency service is offered by Revolut Digital Assets Europe Ltd (RDAEL), and is not regulated other than for the purposes of money laundering. Revolut Digital Assets Europe Ltd (RDAEL) is registered with the Cyprus Securities and Exchange Commission to offer crypto asset services under the Prevention and Suppression of Money Laundering and Terrorist Financing Law. Its registration number is 001/22 and its company registration number is ΗΕ430310. Its registered address is Pikioni, 10 Flat/Office 5, 3075, Limassol, Cyprus.